Strategic Energy Investments

Unmatched Tax Advantages

Tax Treatment That Protects Capital

Long-standing federal tax incentives specific to U.S. energy development function as a built-in subsidy—reducing upfront capital exposure and mitigating downside risk.

Opportunity in Redeveloping Assets

Our proprietary redevelopment model targets undervalued or underperforming assets with untapped potential — unlocking returns through disciplined, data-driven execution.

Partnerships Built on Collaboration

We work closely with accredited investors, mineral owners, and technical experts to align interests, streamline execution, and maximize value at every stage of development.

Investor Educational Resources

Explore curated content on oil and gas fundamentals. Our videos simplify geology, logging, operations, and production—empowering investors with clarity to make informed, responsible decisions.

Redefining Energy Investment Opportunities

We don’t follow the industry’s path — we’ve engineered our own. Our proprietary model integrates advanced analytics, geological intelligence, and operational rigor to revive undervalued assets and convert them into enduring, income-producing properties.

Our Pledge: Maximize Partner Profits

Excellence isn’t accidental — it’s the product of trusted partnerships built on clarity, accountability, and shared success. At Millennium, we unite capital partners, mineral owners, and technical experts to create lasting value across every project.

Tax Policy With Purpose

A landmark federal tax policy enacted in the 1980s encourages private investment in U.S. energy development by providing qualified participants with substantial first-year deductions. These incentives reduce exposure and convert tax liability into working capital.

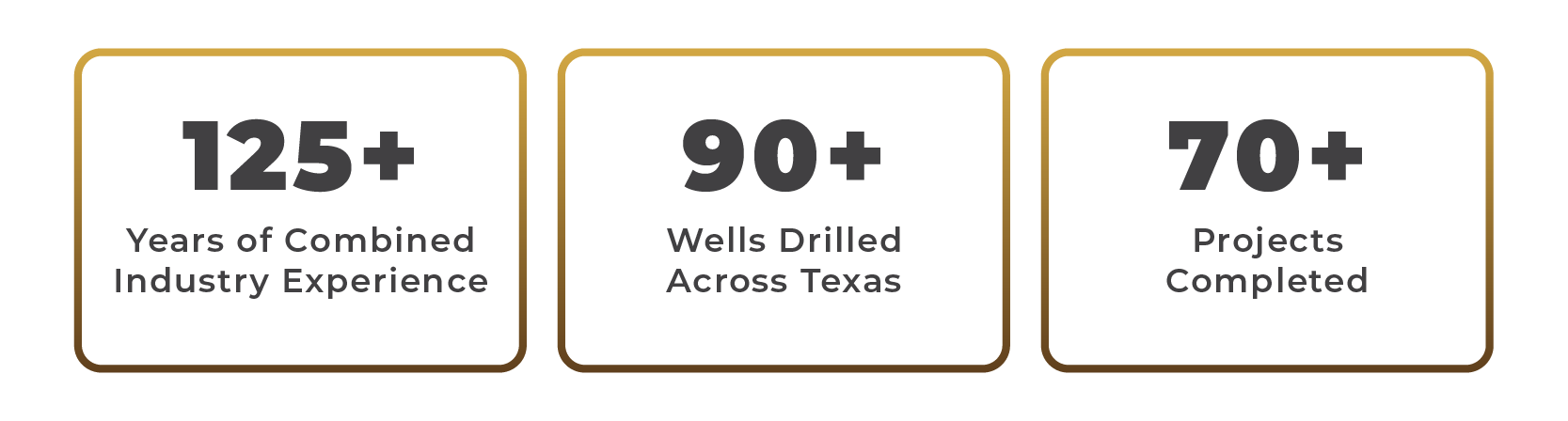

With more than 70 projects executed across 35 Texas counties, we focus on the acquisition, redevelopment, and optimization of undervalued properties in the Texas Gulf Coast Basin — a region defined by proven reserves and repeatable opportunity. By uniting geological accuracy with financial discipline, we deliver decisive execution while managing risk responsibly.

Activities Map

- Aransas

- Bee

- Brazoria

- Brooks

- Caldwell

- Calhoun

- Colorado

- De Witt

- Fort Bend

- Freestone

- Goliad

- Gonzales

- Hidalgo

- Jackson

- Jim Hogg

- Karnes

- Kenedy

- Lavaca

- Leon

- Liberty

- Live Oak

- Matagorda

- Newton

- Nueces

- Ochiltree

- Polk

- Refugio

- San Patricio

- Shackelford

- Throckmorton

- Victoria

- Webb

- Wharton

- Wood

- Zapata